Online buying and selling of currencies refers to forex trading. You can earn a lot of profit even investing a very low. Forex market is a huge and biggest financial market of the world.

$4 Trillion money flow every day. 24 hours and 5 days a week open market. Highest liquidity in the world as compare to the other financial corporate or business.

Every one can start forex trading with a little amount of skill given below.

Basic Knowledge Of Computer And Internet:

It requires install/uninstall programs and handling (Troubleshoot) them. An internet connection with high speed and little skill of surfing.

Basic Knowledge Of Some Trading Terms :

Needs to know what is pips, spread, hedging, buy and sell order, take profit, stop loss, free margin, base and quote currency, leverage, pending order, lot

These terms are the root of the trading and you must have to know their meaning and how they works.

I strongly recommend you don't start forex trading without knowing the upper basic terms. So lets start to understand these trading terms.

The smallest price change in a given rate is called pip. Some broker provide currency price upto 4 decimal points.

E.g. Euro = 1.1285. and if any change in price, it will count in pip.

If Euro price rises and it becomes Eur= 1.1289. It means price change of 4 pip.

All currencies are traded in pair. The value of a currency is determined by its comparison to another currency.

|

| Base - Quote currency |

For example, Eur/Usd = 1.1285. The first currency Euro is called Base currency and second one Usd is called Quote currency.

Buy and Selling actions are performed on the base currency.

E.g. if you perform a buy action on Eur/Usd @ 1.1285. Its means you buy Euro at 1.1285 and 1 Eur = 1.1285 USD and when price rise up this means Euro is getting stronger and Usd is getting weaker. And you will get profit as Euro becomes stronger.

The profit calculated by the no. of pips rise or fall and the value of pip is vary according to the size of trade.This size is called lot.

|

| Lot |

E.g. you perform two buy action on Eur/Usd at 1.1285 with lot 0.5 and 0.3.Now suppose Euro price goes up and it becomes 1.1295.

Then your profit of 10 pips for first buy action with lot 0.5 is =10×0.5 → $ 50

And profit for second buy action with lot 0.3 is = 10×0.3 → $30.

Lot size is depends upon your account balance and leverage provided by the broker.

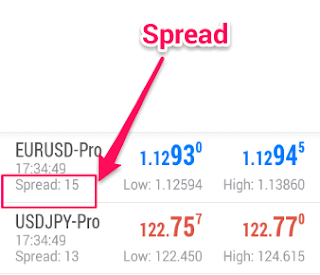

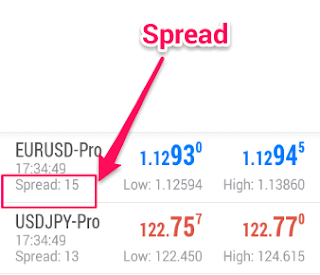

The difference between the buying and selling price in real time market is called spread.

|

| Spread |

Buy order is action of buying currency in real time and similar is sell order. Action is also called a place order.

|

| Buy-Sell |

Sometime trader doesn't sure what happen in real time and predict the movement of currency in a long or short time.

Then place a order in which price is set for future and these order execute only when currency price reach to the price set by trader.

This type of order is called pending order.

Once an order is placed, trader can set the price to take profit for long and short position and when currency price reaches equal to price set by trader, order closes and gained profit sum to the account balance.

|

| Lot-TakeProfit-StopLoss |

Same in case of Stop loss. Trader set a price to reduce the chance of big loss.

It is just like a neutral position of orders placed by trader. when trader place an order and after sometime he/she realize that the his/her prediction is slightly wrong.

Then there is only two option

(1) Close the position with loss or remain in open position in hope of favourable condition.

(2) Hedge the position. It means place a new order of same lot size. If first order placed is buy, the new order will be for sell. This is Hedging.

It gives time to take a right decision and protect the account from a big loss.

It is just like a credit for trader provided by the broker. A leverage tell you how many lot you can use for place order.

High leverage means high volume(big lot size) trade and get big profit with deposit of small amount of money.but it doesn't mean that it always gives you green.

Leverage is "two edge sword".

A big loss also possible if leverage is not used in smart way. An account of $100 with 1:100 leverage means you can control $10000 with your $100 and you can trade up to 1.0 lot size.

It means $10 for each pip. Many brokers provide High leverage up 1:500, 1:800 and so on.

It is just like a short term loan provided by broker and when not given on time an interest may be charged depending on trader's position.

E.g. When trader open an order and losses reaches just close to trader's deposit balance a margin call send by the broker to deposit more fund in account or close the open position.

Margin call set by the broker and depending how much leverage is set for account.

These all are the very first step to start forex trading. Although there are a lot of factors and terms but as a beginner you should have a brief knowledge of these terms.

Because these are cover up 90% of forex market.Other factors are strategy based and they filter your skill in forex trading. Some forex traders use forex robot to make profit without deep knowledge of forex market.